Some Known Details About Commercial Insurance In Dallas Tx

Wiki Article

Examine This Report about Commercial Insurance In Dallas Tx

Table of ContentsThe Only Guide for Life Insurance In Dallas TxExcitement About Home Insurance In Dallas TxSome Of Truck Insurance In Dallas TxThe smart Trick of Truck Insurance In Dallas Tx That Nobody is Talking About

There are several various insurance coverage, as well as understanding which is ideal for you can be challenging. This overview will discuss the different kinds of insurance and also what they cover. We will likewise provide pointers on choosing the right policy for your requirements. Table Of Contents Health and wellness insurance coverage is one of the most vital kinds of insurance coverage that you can have.If you have any type of concerns concerning insurance, contact us as well as request a quote. They can assist you pick the right policy for your requirements. Many thanks for reading! We hope this guide has actually been useful. Call us today if you want tailored solution from a licensed insurance policy agent. For free.

Below are a couple of reasons why term life insurance is the most preferred type. First of all, it is cost-effective. The price of term life insurance policy costs is established based on your age, health and wellness, as well as the protection amount you call for. Particular sorts of company insurance policy might be legally required in some circumstances.

With PPO strategies, you pay higher month-to-month premiums for the liberty to make use of both in-network and also out-of-network carriers without a referral. Paying a costs is comparable to making a monthly car repayment.

An Unbiased View of Commercial Insurance In Dallas Tx

When you have a deductible, you are accountable for paying a specific quantity for insurance coverage solutions prior to your health insurance gives protection. Life insurance can be divided right into two main kinds: term and permanent. Term life insurance gives insurance coverage for a certain period, generally 10 to 30 years, and is extra affordable.We can not prevent the unanticipated from happening, however occasionally we can secure ourselves and our households from the worst of the financial results. Four kinds of insurance that a lot of financial professionals advise include life, health, automobile, and lasting impairment.

It includes a death benefit as well as also a money value element. As the value grows, you can access the cash by taking a car loan or taking out funds and also you can finish the policy by taking the cash value of the policy. Term life covers you for a set quantity of time like 10, 20, or three decades as well as your premiums continue to be steady.

2% of the American population lacked insurance coverage in 2021, the Centers for Disease Control (CDC) reported in its National Center for Wellness Statistics. More than 60% obtained their insurance coverage via a company or in the exclusive insurance industry while the rest were covered by government-subsidized programs consisting of Medicare and also Medicaid, veterans' advantages programs, and also the federal industry established under the Affordable Care Act.

The 8-Second Trick For Home Insurance In Dallas Tx

Investopedia/ Jake Shi Long-term special needs insurance coverage supports those that become unable to function. browse around this site According to the Social Protection Administration, one in four employees getting in the workforce will end up being impaired prior to they reach the age of retirement. While medical insurance spends for hospitalization as well as clinical bills, you are often burdened with every one of the expenditures that your paycheck had actually covered.

Mostly all states need vehicle drivers to have car insurance coverage and the couple of that don't still hold vehicle drivers monetarily in charge of any type of damage or injuries they cause. Here are your options when acquiring vehicle insurance coverage: Responsibility insurance coverage: Pays for residential property damage as well as injuries you cause to others if you're at mistake for a mishap as well as likewise covers lawsuits costs and judgments or negotiations if you're filed a claim against due to the fact that of a vehicle mishap.

Company insurance coverage is often the finest option, yet if that is unavailable, acquire quotes from several companies as many provide discounts if you acquire greater than one kind of insurance coverage.

The Ultimate Guide To Commercial Insurance In Dallas Tx

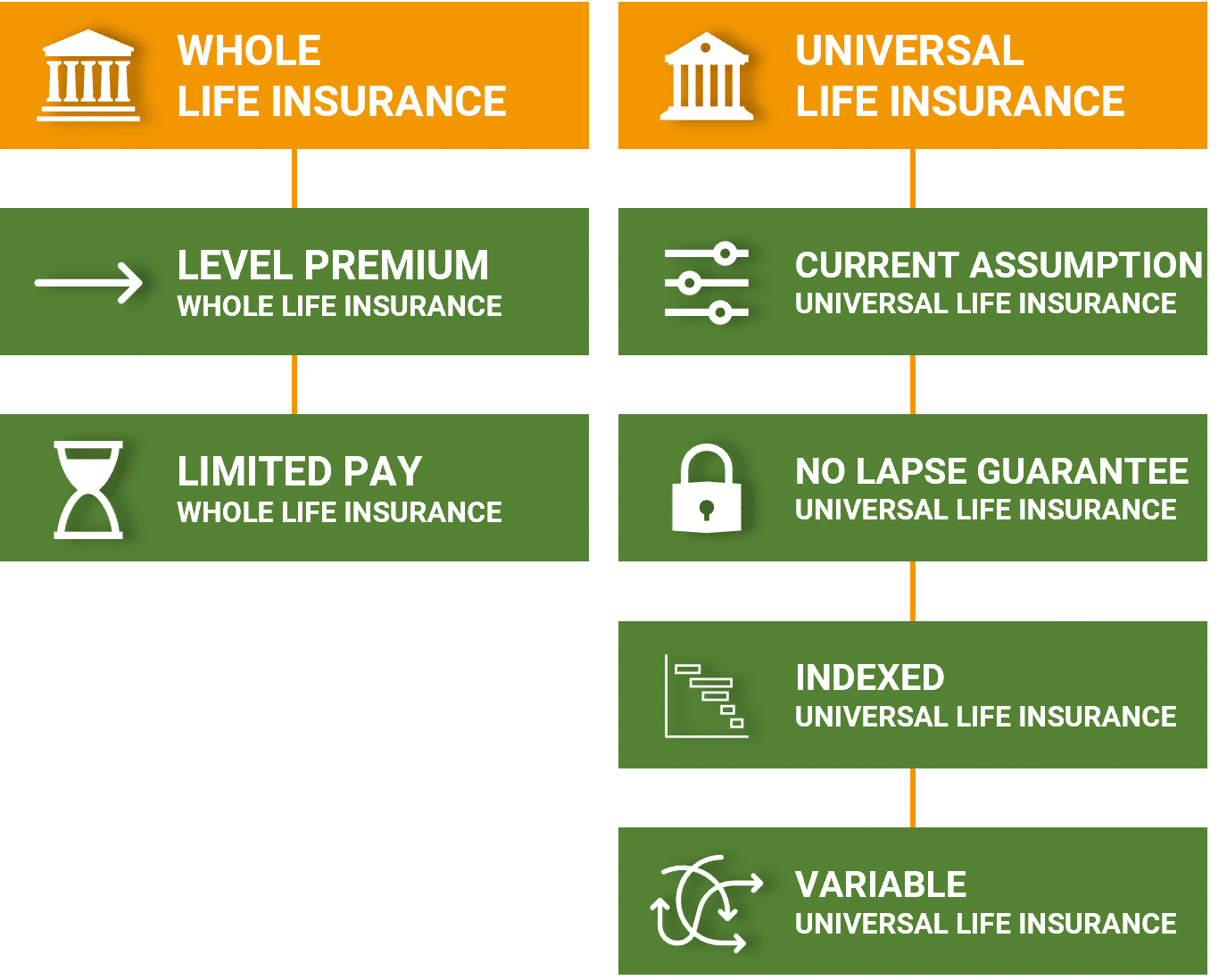

The appropriate plan for you will depend upon your individual conditions, just how much insurance coverage you require, and also just how much you intend to pay for it. This overview covers the most common sorts of life insurance policy policies on the market, consisting of information on just how they work, their benefits and drawbacks, how much time they last, as well as who they're finest for.

This is the most preferred type of life insurance policy for many people since it's inexpensive, just lasts for as lengthy as you need it, as well as includes few tax obligation regulations and restrictions. Term life insurance coverage is just one of the most convenient and cheapest means to supply a financial safeguard for your liked ones.

You pay premiums my website towards the policy, and also if you die during the term, the insurance provider pays a set amount of money, understood as the fatality advantage, to your designated recipients. The death benefit can be paid out as a lump amount or an annuity. Most individuals select to get the fatality benefit as a round figure to avoid paying tax obligations on any earned rate of interest. Home insurance in click here for info Dallas TX.

Report this wiki page